Practical Examples

In addition to the code snippets included below, all of the Groovy and Python code for the recipes below can be downloaded as premade Deephaven Notebooks. To learn more about using Deephaven Notebooks, please refer to the Notebook section of the User Manual.

Download the Query Cookbook Notebooks

Downsampling Trades

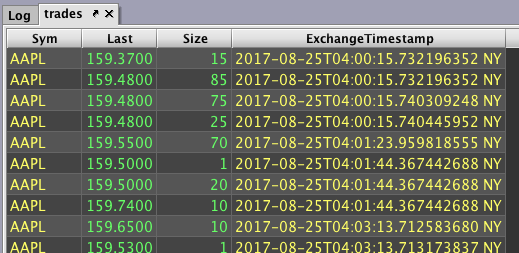

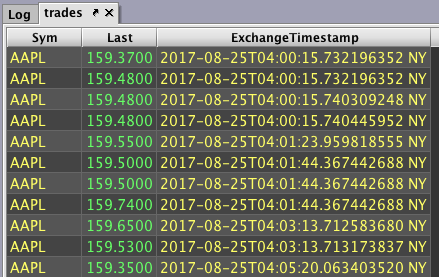

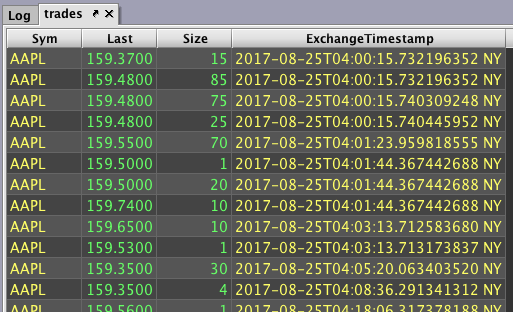

Step 1: Pull trades for a certain date and remove some columns.

trades = db.t("LearnDeephaven", "StockTrades")

.where("Date=`2017-08-25`")

.view("Sym", "Last", "Size", "ExchangeTimestamp")

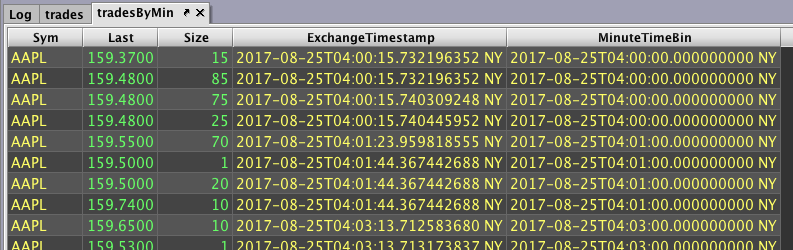

Step 2: Decide the value for downsampling and create a new column to hold those values

To downsample our trades, we need to decide on the time intervals to which we want to downsample. For this example, we will specify one minute.

tradesByMin = trades.updateView("MinuteTimeBin=lowerBin(ExchangeTimestamp, MINUTE)")

We haven't downsampled yet. We've simply added a column to bin the time, which is the closest whole minute (rounding down).

Step 3: Downsample trades based on the closest minute after the trade is completed.

downsample = tradesByMin.firstBy("Sym", "MinuteTimeBin")

This query keeps the first trade for each symbol that occurred every minute and discards any other trades for that symbol during that same minute. The table now shows only one trade per minute per symbol.

Note: This recipes downsamples trades to the first trade of each minute by using lowerBin and firstBy(). However, one could downsample to the last trade each minute by using upperBin and lastBy().

Complete Code Blocks for the Downsampling Trades Recipe

trades = db.t("LearnDeephaven", "StockTrades")

.where("Date=`2017-08-25`")

.view("Sym", "Last", "Size", "ExchangeTimestamp")

tradesByMin = trades.updateView("MinuteTimeBin=lowerBin(ExchangeTimestamp, MINUTE)")

downsample = tradesByMin.firstBy("Sym", "MinuteTimeBin")# Initial import

from deephaven import *

print("Provides:\n"

"\tdeephaven.Calendars as cals\n"

"\tdeephaven.ComboAggregateFactory as caf\n"

"\tdeephaven.DBTimeUtils as dbtu\n"

"\tdeephaven.Plot as plt\n"

"\tdeephaven.Plot.figure_wrapper as figw\n"

"\tdeephaven.QueryScope as qs\n"

"\tdeephaven.TableManagementTools as tmt\n"

"\tdeephaven.TableTools as ttools\n"

"See print(sorted(dir())) for the full namespace contents.")

# Downsampling Trades

trades = db.t("LearnDeephaven", "StockTrades")\

.where("Date=`2017-08-25`")\

.view("Sym", "Last", "Size", "ExchangeTimestamp")

tradesByMin = trades.updateView("MinuteTimeBin=lowerBin(ExchangeTimestamp, MINUTE)")

downsample = tradesByMin.firstBy("Sym", "MinuteTimeBin")

Price Volatility

Step 1: Pull day-by-day trade summaries for each symbol over a year.

summaries = db.t("LearnDeephaven", "EODTrades").where("ImportDate=`2017-11-01`")

Step 2: Calculate daily return for rows with the same ticker value.

returns = summaries.updateView("Return=(Ticker=Ticker_[i-1]) ? log(Close/Close_[i-1]) : NULL_DOUBLE")

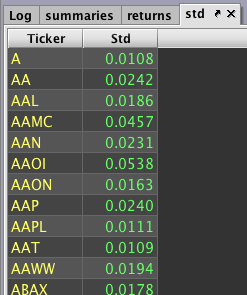

Step 3: Calculate standard deviation of returns for each symbol.

std = returns.view("Ticker", "Std=Return").stdBy("Ticker")

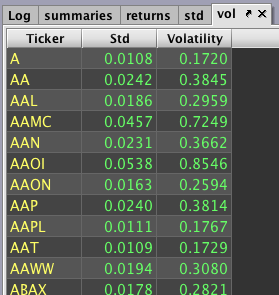

Step 4: Create a constant for the annualization factor.

trading_days = 252

annualization = sqrt(trading_days)

Step 5: Calculate volatility.

vol = std.updateView("Volatility=annualization*Std")

Complete Code Blocks for the Price Volatility Recipe

summaries = db.t("LearnDeephaven", "EODTrades").where("ImportDate=`2017-11-01`")

returns = summaries.updateView("Return=(Ticker=Ticker_[i-1]) ? log(Close/Close_[i-1]) : NULL_DOUBLE")

std = returns.view("Ticker", "Std=Return").stdBy("Ticker")

trading_days = 252

annualization = sqrt(trading_days)

vol = std.updateView("Volatility=annualization*Std")# Initial import

from deephaven import *

# Price Volatility

summaries = db.t("LearnDeephaven", "EODTrades").where("ImportDate=`2017-11-01`")

returns = summaries.updateView("Return=(Ticker=Ticker_[i-1]) ? log(Close/Close_[i-1]) : NULL_DOUBLE")

std = returns.view("Ticker", "Std=Return").stdBy("Ticker")

trading_days = 252

annualization = trading_days ** 0.5

vol = std.updateView("Volatility=annualization*Std")

Returns

Step 1: Pull trades for a certain date and remove some columns.

trades = db.t("LearnDeephaven", "StockTrades")

.where("Date=`2017-08-25`")

.view("Sym", "Last", "ExchangeTimestamp")

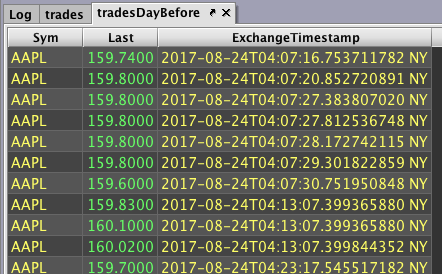

Step 2: Pull trades for the day before and remove some columns.

tradesDayBefore = db.t("LearnDeephaven", "StockTrades")

.where("Date=`2017-08-24`")

.view("Sym", "Last", "ExchangeTimestamp")

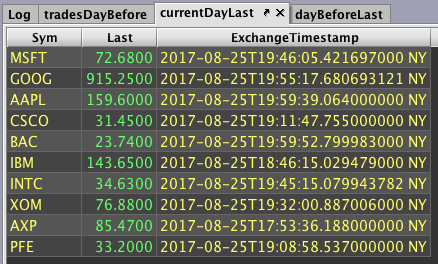

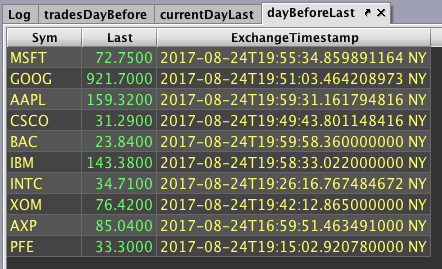

Step 3: Get the last trade for each symbol on both days.

currentDayLast = trades.lastBy("Sym")

dayBeforeLast = tradesDayBefore.lastBy("Sym")

Step 4: Join the last trade price from the day before to the current and subtract their prices.

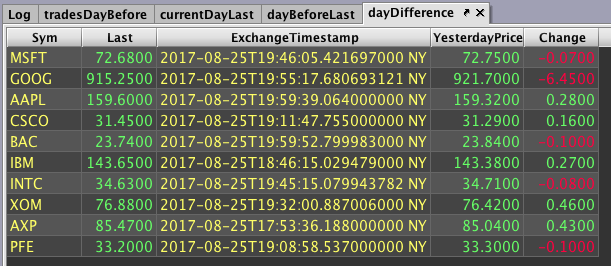

dayDifference = currentDayLast.exactJoin(dayBeforeLast, "Sym", "YesterdayPrice=Last")

.updateView("Change=Last-YesterdayPrice")

Step 5: Calculate returns from the day before and format them to percentages.

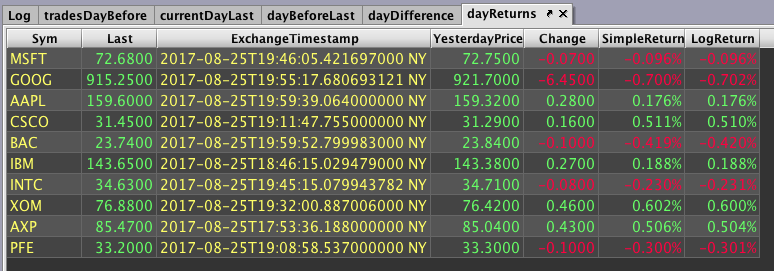

dayReturns = dayDifference.updateView("SimpleReturn=Change/YesterdayPrice", "LogReturn=log(Last/YesterdayPrice)")

.formatColumns("SimpleReturn=Decimal(`0.000%`)", "LogReturn=Decimal(`0.000%`)")

Next, we need to calculate the hourly returns. This is accomplished over the next three steps.

Step 6: Add a column that holds time values one hour before the ExchangeTimestamp column.

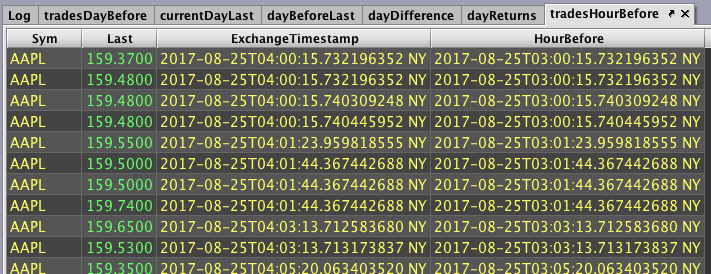

tradesHourBefore = trades.updateView("HourBefore=ExchangeTimestamp - HOUR")

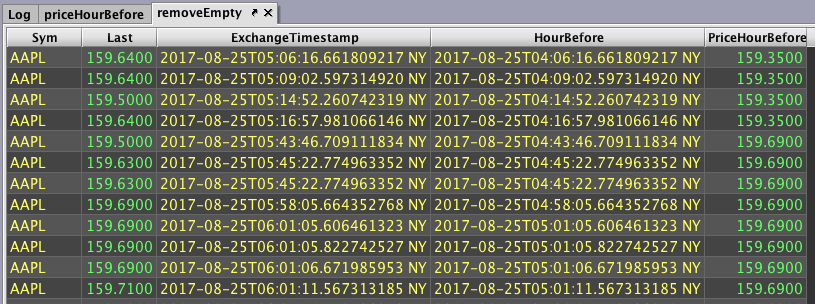

Step 7: For each row under a given symbol, join the most recent price by the modified time.

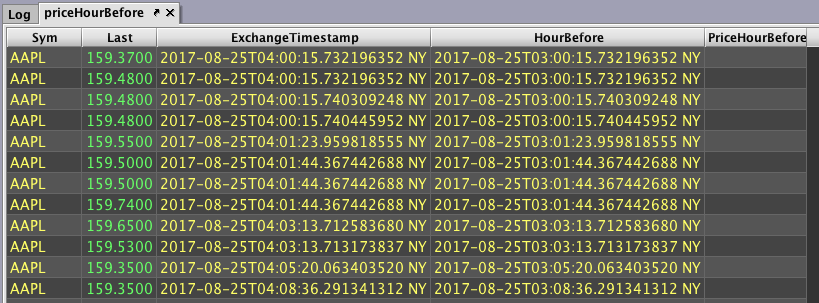

priceHourBefore = tradesHourBefore.aj(tradesHourBefore, "Sym, HourBefore=ExchangeTimestamp", "PriceHourBefore=Last")

Step 8: To get a better look at the result, let's get rid of of any rows with empty cells.

Note: The exclamation point changes the meaning of a method. For example, in the previous query, rather than checking if PriceHourBefore is null, you're checking if PriceHourBefore is not null.

removeEmpty = priceHourBefore.where("!isNull(PriceHourBefore)")

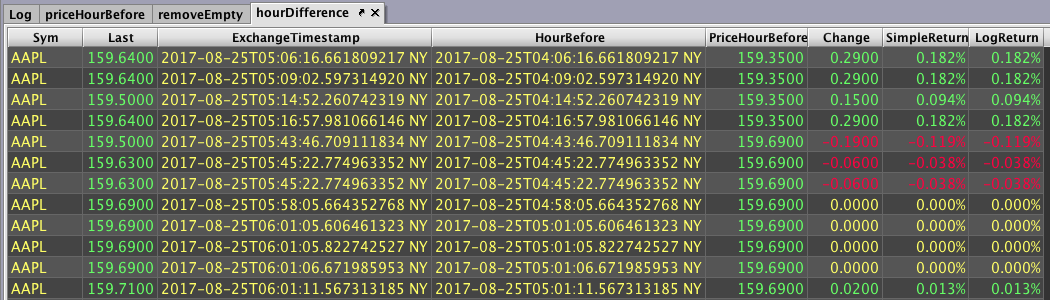

Step 9: Calculate hourly returns.

hourDifference = removeEmpty.updateView("Change=Last-PriceHourBefore", "SimpleReturn=Change/PriceHourBefore", "LogReturn=log(Last/PriceHourBefore)")

.formatColumns("SimpleReturn=Decimal(`0.000%`)", "LogReturn=Decimal(`0.000%`)")

Complete Code Blocks for the Returns Recipe

trades = db.t("LearnDeephaven", "StockTrades")

.where("Date=`2017-08-25`")

.view("Sym", "Last", "ExchangeTimestamp")

tradesDayBefore = db.t("LearnDeephaven", "StockTrades")

.where("Date=`2017-08-24`")

.view("Sym", "Last", "ExchangeTimestamp")

currentDayLast = trades.lastBy("Sym")

dayBeforeLast = tradesDayBefore.lastBy("Sym")

dayDifference = currentDayLast.exactJoin(dayBeforeLast, "Sym", "YesterdayPrice=Last")

.updateView("Change=Last-YesterdayPrice")

dayReturns = dayDifference.updateView("SimpleReturn=Change/YesterdayPrice", "LogReturn=log(Last/YesterdayPrice)")

.formatColumns("SimpleReturn=Decimal(`0.000%`)", "LogReturn=Decimal(`0.000%`)")

tradesHourBefore = trades.updateView("HourBefore=ExchangeTimestamp - HOUR")

priceHourBefore = tradesHourBefore.aj(tradesHourBefore, "Sym, HourBefore=ExchangeTimestamp", "PriceHourBefore=Last")

removeEmpty = priceHourBefore.where("!isNull(PriceHourBefore)")

hourDifference = removeEmpty.updateView("Change=Last-PriceHourBefore", "SimpleReturn=Change/PriceHourBefore", "LogReturn=log(Last/PriceHourBefore)")

.formatColumns("SimpleReturn=Decimal(`0.000%`)", "LogReturn=Decimal(`0.000%`)")# Initial import

from deephaven import *

# Returns

trades = db.t("LearnDeephaven", "StockTrades")\

.where("Date=`2017-08-25`")\

.view("Sym", "Last", "ExchangeTimestamp")

tradesDayBefore = db.t("LearnDeephaven", "StockTrades")\

.where("Date=`2017-08-24`")\

.view("Sym", "Last", "ExchangeTimestamp")

currentDayLast = trades.lastBy("Sym")

dayBeforeLast = tradesDayBefore.lastBy("Sym")

dayDifference = currentDayLast.exactJoin(dayBeforeLast, "Sym", "YesterdayPrice=Last")\

.updateView("Change=Last-YesterdayPrice")

dayReturns = dayDifference.updateView("SimpleReturn=Change/YesterdayPrice", "LogReturn=log(Last/YesterdayPrice)")\

.formatColumns("SimpleReturn=Decimal(`0.000%`)", "LogReturn=Decimal(`0.000%`)")

tradesHourBefore = trades.updateView("HourBefore=ExchangeTimestamp - HOUR")

priceHourBefore = tradesHourBefore.aj(tradesHourBefore, "Sym, HourBefore=ExchangeTimestamp", "PriceHourBefore=Last")

removeEmpty = priceHourBefore.where("!isNull(PriceHourBefore)")

hourDifference = removeEmpty.updateView("Change=Last-PriceHourBefore", "SimpleReturn=Change/PriceHourBefore", "LogReturn=log(Last/PriceHourBefore)")\

.formatColumns("SimpleReturn=Decimal(`0.000%`)", "LogReturn=Decimal(`0.000%`)")

Pair Trading Analysis

Step 1: Write custom code to calculate rolling averages and standard deviations.

Custom code will be needed later to calculate rolling averages and standard deviations. Let's write these functions first.

rollingAvg = { rows, values ->

calculations = new double[values.size()]

sum = 0

n = 0

for (long i = 0; i < values.size(); ++i)

{

if (i < rows) n++ //n increments with i until n=rows

sum += values.get(i) //add each value to sum

if (i >= rows) sum -= values.get((long)(i - rows)) //subtract when needed

calculations[(int)i] = sum/n //store running average

}

return calculations //return an array of rolling averages

}

rollingStd = { rows, values ->

// NOTE: variance(X) is most efficiently calculated as E(X^2) - E(X)^2

calculations = new double[values.size()]

n = 0

sum = 0

sum2 = 0

for (long i = 0; i < values.size(); ++i)

{

if (i < rows) n++ //n increments with i until n=rows

val = values.get(i)

sum2 += val*val

sum += val

if (i >= rows){

val = values.get((long)(i - rows))

sum -= val //subtract when needed

sum2 -= val*val

}

variance = sum2/n - (sum*sum)/(n*n)

calculations[(int)i] = (variance > 0) ? Math.sqrt(variance): 0 // account for numerical imprecision near 0

}

return calculations

}

Step 2: Start the query script to select two symbols to compare and the latest date to use in the analysis.

pair = ["MSFT", "GOOG"]

latestDate = "2017-08-21"

Step 3: Pull all trades from the latest date onwards for the specified symbols and reduce the table.

trades = db.t("LearnDeephaven", "StockTrades")

.where("Date>=latestDate", "Sym in pair")

.view("Date", "Sym", "Last")

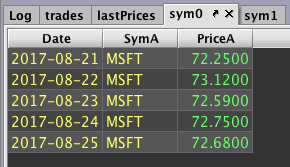

Step 4: Get the last trade price for each day and each symbol.

lastPrices = trades.by(AggCombo(AggLast("Last")), "Date", "Sym")

Step 5: Create two tables, each containing trades for a single symbol and rename their columns.

sym0 = lastPrices.where("Sym=pair[0]")

.renameColumns("SymA=Sym", "PriceA=Last")

sym1 = lastPrices.where("Sym=pair[1]")

.renameColumns("SymB=Sym", "PriceB=Last")

Step 6: Join these tables together so their prices can be side-by-side.

sideBySide = sym0.naturalJoin(sym1, "Date")

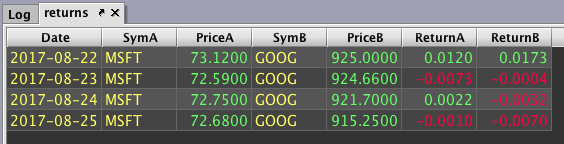

Step 7: Calculate daily returns and drop the row without a return.

This will show us how correlated the symbols' returns are before we analyze the pair's prices.

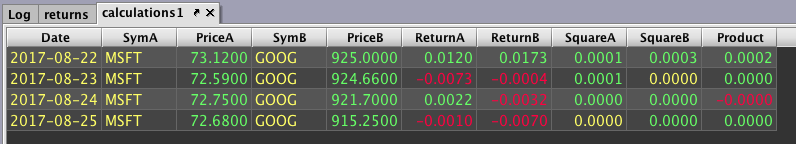

returns = sideBySide.updateView("ReturnA=log(PriceA/PriceA_[i-1])", "ReturnB=log(PriceB/PriceB_[i-1])")

.where("!isNull(ReturnA) && !isNull(ReturnB)")

Step 8: Calculate the square and product for each row.

calculations1 = returns.updateView("SquareA=ReturnA*ReturnA", "SquareB=ReturnB*ReturnB", "Product=ReturnA*ReturnB")

Step 9: Calculate the count and the sum of returns, squares, and products.

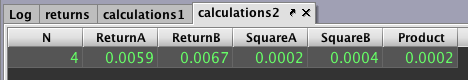

calculations2 = calculations1.by(AggCombo(AggCount("N"), AggSum("ReturnA", "ReturnB", "SquareA", "SquareB", "Product")))

All the information needed to calculate the correlation is now available.

Step 10: Calculate the correlation.

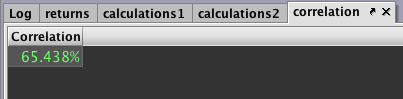

correlation = calculations2.view("Correlation=((N * Product) - (ReturnA * ReturnB)) / sqrt((N * SquareA - pow(ReturnA, 2)) * (N * SquareB - pow(ReturnB, 2)))")

.formatColumns("Correlation=Decimal(`0.000%`)")

Step 11: Return to the pair analysis. Calculate the price ratio from the sideBySide table.

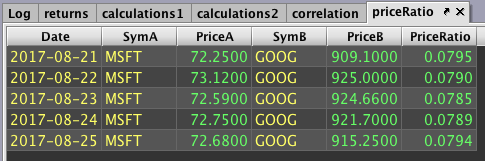

priceRatio = sideBySide.updateView("PriceRatio=PriceA/PriceB")

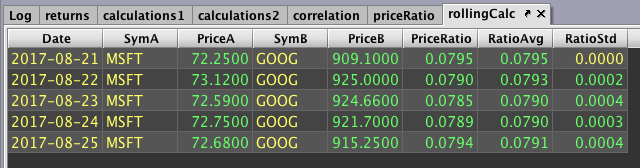

Step 12: Calculate rolling average and standard deviation using our custom functions.

rollingCalc = priceRatio.by()

.updateView("RatioAvg=(double[])rollingAvg.call(20, PriceRatio)", "RatioStd=(double[])rollingStd.call(20, PriceRatio)")

.ungroup()

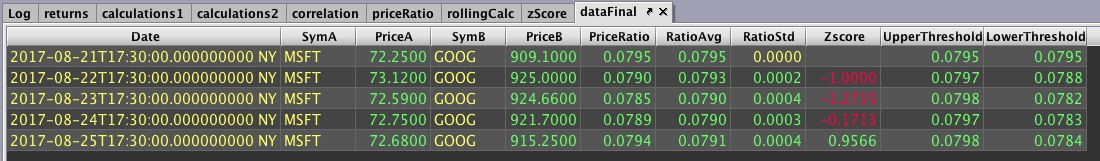

Step 13: Calculate z-score as well as values two z-scores above and under average.

zScore = rollingCalc.updateView("Zscore=(RatioStd != 0) ? (PriceRatio-RatioAvg)/RatioStd: NULL_DOUBLE",

"UpperThreshold=RatioAvg+2*RatioStd", "LowerThreshold=RatioAvg-2*RatioStd")

Step 14: To create time plots for visualizing the data, we first need to convert our dates to the proper time format.

dataFinal = zScore.updateView("Date=convertDateTime(Date+`T17:30 NY`)")

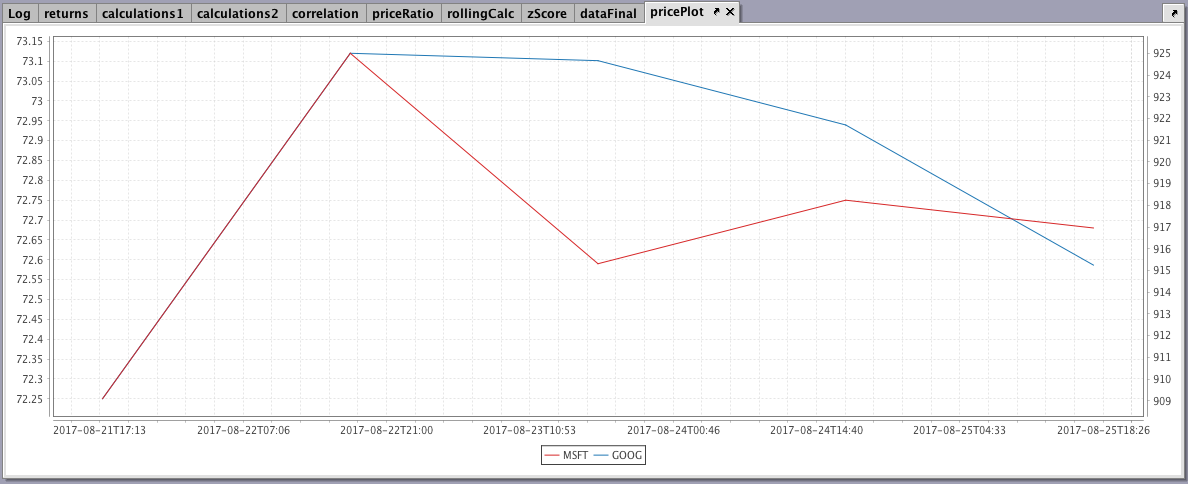

Step 15: Create a dual time plot for the symbols' prices.

pricePlot = plot(pair[0], dataFinal, "Date", "PriceA")

.twinX().plot(pair[1], dataFinal, "Date", "PriceB").show()

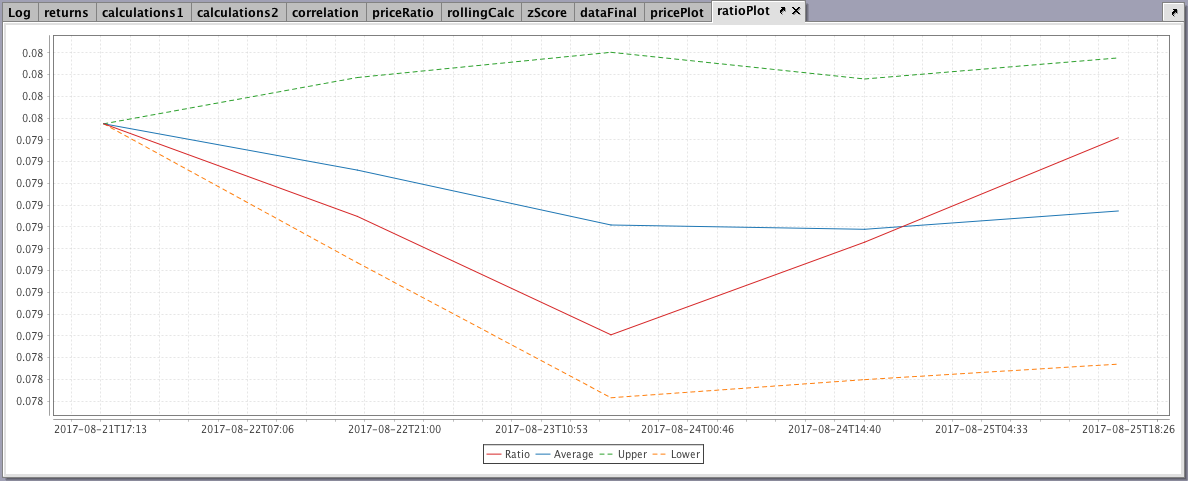

Step 16: Finally, create a time plot for our price ratio, average, and upper/lower thresholds.

ratioPlot = plot("Ratio", dataFinal, "Date", "PriceRatio")

.plot("Average", dataFinal, "Date", "RatioAvg")

.plot("Upper", dataFinal, "Date", "UpperThreshold")

.lineStyle(lineStyle([4,4]))

.plot("Lower", dataFinal, "Date", "LowerThreshold")

.lineStyle(lineStyle([4,4]))

.show()

Complete Code Blocks for the Pairs Trading Analysis Recipe

rollingAvg = { rows, values ->

calculations = new double[values.size()]

sum = 0

n = 0

for (long i = 0; i < values.size(); ++i)

{

if (i < rows) n++ //n increments with i until n=rows

sum += values.get(i) //add each value to sum

if (i >= rows) sum -= values.get((long)(i - rows)) //subtract when needed

calculations[(int)i] = sum/n //store running average

}

return calculations //return an array of rolling averages

}

rollingStd = { rows, values ->

// NOTE: variance(X) is most efficiently calculated as E(X^2) - E(X)^2

calculations = new double[values.size()]

n = 0

sum = 0

sum2 = 0

for (long i = 0; i < values.size(); ++i)

{

if (i < rows) n++ //n increments with i until n=rows

val = values.get(i)

sum2 += val*val

sum += val

if (i >= rows){

val = values.get((long)(i - rows))

sum -= val //subtract when needed

sum2 -= val*val

}

variance = sum2/n - (sum*sum)/(n*n)

calculations[(int)i] = (variance > 0) ? Math.sqrt(variance): 0 // account for numerical imprecision near 0

}

return calculations

}

pair = ["MSFT", "GOOG"]

latestDate = "2017-08-21"

trades = db.t("LearnDeephaven", "StockTrades")

.where("Date>=latestDate", "Sym in pair")

.view("Date", "Sym", "Last")

lastPrices = trades.by(AggCombo(AggLast("Last")), "Date", "Sym")

sym0 = lastPrices.where("Sym=pair[0]")

.renameColumns("SymA=Sym", "PriceA=Last")

sym1 = lastPrices.where("Sym=pair[1]")

.renameColumns("SymB=Sym", "PriceB=Last")

sideBySide = sym0.naturalJoin(sym1, "Date")

returns = sideBySide.updateView("ReturnA=log(PriceA/PriceA_[i-1])", "ReturnB=log(PriceB/PriceB_[i-1])")

.where("!isNull(ReturnA) && !isNull(ReturnB)")

calculations1 = returns.updateView("SquareA=ReturnA*ReturnA", "SquareB=ReturnB*ReturnB", "Product=ReturnA*ReturnB")

calculations2 = calculations1.by(AggCombo(AggCount("N"), AggSum("ReturnA", "ReturnB", "SquareA", "SquareB", "Product")))

correlation = calculations2.view("Correlation=((N * Product) - (ReturnA * ReturnB)) / sqrt((N * SquareA - pow(ReturnA, 2)) * (N * SquareB - pow(ReturnB, 2)))")

.formatColumns("Correlation=Decimal(`0.000%`)")

priceRatio = sideBySide.updateView("PriceRatio=PriceA/PriceB")

rollingCalc = priceRatio.by()

.updateView("RatioAvg=(double[])rollingAvg.call(20, PriceRatio)", "RatioStd=(double[])rollingStd.call(20, PriceRatio)")

.ungroup()

zScore = rollingCalc.updateView("Zscore=(RatioStd != 0) ? (PriceRatio-RatioAvg)/RatioStd: NULL_DOUBLE",

"UpperThreshold=RatioAvg+2*RatioStd", "LowerThreshold=RatioAvg-2*RatioStd")

dataFinal = zScore.updateView("Date=convertDateTime(Date+`T17:30 NY`)")

pricePlot = plot(pair[0], dataFinal, "Date", "PriceA")

.twinX()

.plot(pair[1], dataFinal, "Date", "PriceB")

.show()

ratioPlot = plot("Ratio", dataFinal, "Date", "PriceRatio")

.plot("Average", dataFinal, "Date", "RatioAvg")

.plot("Upper", dataFinal, "Date", "UpperThreshold")

.lineStyle(lineStyle([4,4]))

.plot("Lower", dataFinal, "Date", "LowerThreshold")

.lineStyle(lineStyle([4,4]))

.show()# Initial import

from deephaven import *

# Pair Trading Analysis

def rollingAvg(rows, values):

calculations = jpy.array('double', values.size()) # create an array of doubles

sum = 0

n = 0

for i in range(values.size()):

if (i < rows): n += 1 # n increments with i until n = rows

sum += values.get(i) # add each value to sum

if (i >= rows): sum -= values.get(i - rows) # subtract when needed

avg = sum/n # get updated average every iteration

calculations[i] = avg # store running average

return calculations # return an array of rolling averages

def rollingStd(rows, values):

# Can we use numpy and convolution here instead?

# some other kind of vectorization?

calculations = jpy.array('double', values.size()) # create an array of doubles

sum2 = 0

sum = 0

n = 0

for i in range(values.size()):

if (i < rows): n += 1 # n increments with i until n=rows

val = values.get(i)

sum += val

sum2 += val*val

if i >= rows:

# subtract when needed

val = values.get(i-rows)

sum -= val

sum2 -= val*val

variance = sum2/n - (sum*sum/(n*n))

calculations[i] = variance**0.5 if variance > 0 else 0 # account for numerical precision near 0

return calculations

pair = jpy.array('java.lang.String', 2)

pair[0] = "MSFT"

pair[1] = "GOOG"

latestDate = "2017-08-21"

trades = db.t("LearnDeephaven", "StockTrades")\

.where("Date>=latestDate", "Sym in pair")\

.view("Date", "Sym", "Last")

lastPrices = trades.by(caf.AggCombo(caf.AggLast("Last")), "Date", "Sym")

sym0 = lastPrices.where("Sym=pair[0]")\

.renameColumns("SymA=Sym", "PriceA=Last")

sym1 = lastPrices.where("Sym=pair[1]")\

.renameColumns("SymB=Sym", "PriceB=Last")

sideBySide = sym0.naturalJoin(sym1, "Date")

returns = sideBySide.updateView("ReturnA=log(PriceA/PriceA_[i-1])", "ReturnB=log(PriceB/PriceB_[i-1])")\

.where("!isNull(ReturnA) && !isNull(ReturnB)")

calculations1 = returns.updateView("SquareA=ReturnA*ReturnA", "SquareB=ReturnB*ReturnB", "Product=ReturnA*ReturnB")

calculations2 = calculations1.by(caf.AggCombo(caf.AggCount("N"), caf.AggSum("ReturnA", "ReturnB", "SquareA", "SquareB", "Product")))

correlation = calculations2.view("Correlation=(N * (Product - (ReturnA * ReturnB))) / sqrt((N * SquareA - pow(ReturnA, 2)) * (N * SquareB - pow(ReturnB, 2)))")\

.formatColumns("Correlation=Decimal(`0.000%`)")

priceRatio = sideBySide.updateView("PriceRatio=PriceA/PriceB")

rollingCalc = priceRatio.by()\

.updateView("RatioAvg=(double[])rollingAvg.call(20, PriceRatio)", "RatioStd=(double[])rollingStd.call(20, PriceRatio)")\

.ungroup()

zScore = rollingCalc.updateView("Zscore=(PriceRatio-RatioAvg)/RatioStd", "UpperThreshold=RatioAvg+2*RatioStd", "LowerThreshold=RatioAvg-2*RatioStd")

dataFinal = zScore.updateView("Date=convertDateTime(Date+`T17:30 NY`)")Mean Reversion Simulation

Step 1: Write functions to calculate rolling averages and standard deviations.

Custom code will be needed later to calculate rolling averages and standard deviations. Let's write these functions first.

rollingAvg = { rows, values ->

calculations = new double[values.size()]

sum = 0

n = 0

for (long i = 0; i < values.size(); ++i)

{

if (i < rows) n++ //n increments with i until n=rows

sum += values.get(i) //add each value to sum

if (i >= rows) sum -= values.get((long)(i - rows)) //subtract when needed

calculations[(int)i] = sum/n //store running average

}

return calculations //return an array of rolling averages

}

rollingStd = { rows, values ->

// NOTE: variance(X) is most efficiently calculated as E(X^2) - E(X)^2

calculations = new double[values.size()]

n = 0

sum = 0

sum2 = 0

for (long i = 0; i < values.size(); ++i)

{

if (i > rows) n++ //n increments with i until n=rows

val = values.get(i)

sum2 += val*val

sum += val

if (i >= rows){

val = values.get((long)(i - rows))

sum -= val //subtract when needed

sum2 -= val*val

}

variance = sum2/n - (sum*sum)/(n*n)

calculations[(int)i] = (variance > 0) ? Math.sqrt(variance): 0 // account for numerical imprecision near 0

}

return calculations

}

Step 2: Pull trades from a certain date and reduce the table:

trades = db.t("LearnDeephaven", "StockTrades")

.where("Date=`2017-08-25`")

.view("Sym", "Last", "Size", "ExchangeTimestamp")

Step 3: Downsample trades to every thirty minutes:

trades30min = trades.updateView("TimeBin=lowerBin(ExchangeTimestamp, 30*MINUTE)")

.firstBy("Sym", "TimeBin")

Step 4: Calculate rolling averages and standard deviations:

rollingCalc = trades30min.by("Sym")

.update("Avg=(double[])rollingAvg.call(30, Last)", "Std=(double[])rollingStd.call(30, Last)")

.ungroup()

Step 5: Set some constants used to calculate target positions:

minEdge = 0.5d

maxPos = 3.0d

liquidity = 1e6d

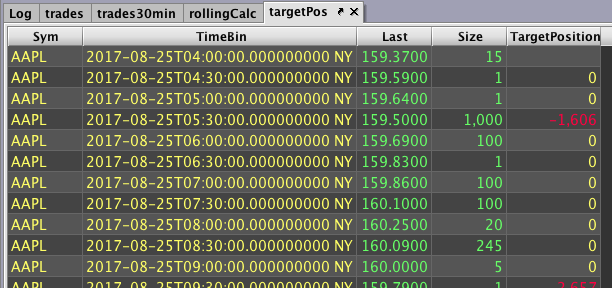

Step 6: Calculate target positions:

targetPos = rollingCalc.updateView("Zscore=(Std > 0) ? (Avg-Last)/Std : NULL_DOUBLE", "AdjZscore=signum(Zscore) * min(maxPos, max(abs(Zscore)-minEdge), 0.0)", "TargetPosition=(int)(liquidity*AdjZscore/Last)")

.dropColumns("ExchangeTimestamp", "Avg", "Std", "Zscore", "AdjZscore")

Step 7: Calculate start and end indexes so we can later calculate shares traded every thirty minutes:

timeBinIndexes = targetPos.leftJoin(trades30min, "Sym", "Times=ExchangeTimestamp, SharesTraded=Size")

.updateView("StartIndex=binSearchIndex(Times, TimeBin-30*MINUTE, BS_LOWEST)", "EndIndex=binSearchIndex(Times, TimeBin, BS_HIGHEST)")

.dropColumns("Times")

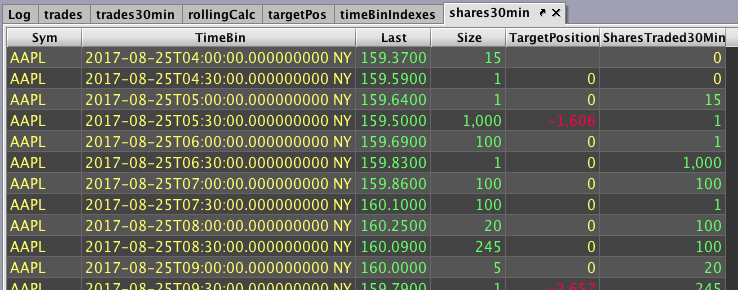

Step 8: Calculate the amount of shares traded every thirty minutes:

shares30min = timeBinIndexes.updateView("SharesTraded30Min=sum(SharesTraded.subArray(StartIndex, EndIndex))")

.dropColumns("SharesTraded", "StartIndex", "EndIndex")

Step 9: Create a class that simulates trade actions and positions for each row of every symbol:

class SimulatorState

{

private HashMap<String, double[]> hm = new HashMap<>()

double[] update(String sym, int targetPos, int shares10s){

if (!hm.containsKey(sym)) hm.put(sym, new double[2])

double[] tradedAndPosition = hm.get(sym)

tradedAndPosition[0] = isNull(targetPos) ? 0.0 : signum(targetPos - tradedAndPosition[1]) * min(abs(targetPos - tradedAndPosition[1]), shares10s * 0.1d)

tradedAndPosition[1] += tradedAndPosition[0]

return Arrays.copyOf(tradedAndPosition, tradedAndPosition.length)

}

}

ss = new SimulatorState()

Step 10: Utilize class to add columns for trade actions and positions:

simulation = shares30min.update("Values=(double[])ss.update(Sym, TargetPosition, SharesTraded30Min)", "PositionChange=Values[0]", "Position=Values[1]")

.dropColumns("Values")

Complete Code Blocks for the Mean Reversion Simulation Recipe

rollingAvg = { rows, values ->

calculations = new double[values.size()]

sum = 0

n = 0

for (long i = 0; i < values.size(); ++i)

{

if (i < rows) n++ //n increments with i until n=rows

sum += values.get(i) //add each value to sum

if (i >= rows) sum -= values.get((long)(i - rows)) //subtract when needed

calculations[(int)i] = sum/n //store running average

}

return calculations //return an array of rolling averages

}

rollingStd = { rows, values ->

// NOTE: variance(X) is most efficiently calculated as E(X^2) - E(X)^2

calculations = new double[values.size()]

n = 0

sum = 0

sum2 = 0

for (long i = 0; i < values.size(); ++i)

{

if (i > rows) n++ //n increments with i until n=rows

val = values.get(i)

sum2 += val*val

sum += val

if (i >= rows){

val = values.get((long)(i - rows))

sum -= val //subtract when needed

sum2 -= val*val

}

variance = sum2/n - (sum*sum)/(n*n)

calculations[(int)i] = (variance > 0) ? Math.sqrt(variance): 0 // account for numerical imprecision near 0

}

return calculations

}

trades = db.t("LearnDeephaven", "StockTrades")

.where("Date=`2017-08-25`")

.view("Sym", "Last", "Size", "ExchangeTimestamp")

trades30min = trades.updateView("TimeBin=lowerBin(ExchangeTimestamp, 30*MINUTE)")

.firstBy("Sym", "TimeBin")

rollingCalc = trades30min.by("Sym")

.update("Avg=(double[])rollingAvg.call(30, Last)","Std=(double[])rollingStd.call(30, Last)")

.ungroup()

minEdge = 0.5d

maxPos = 3.0d

liquidity = 1e6d

targetPos = rollingCalc.updateView("Zscore=(Std > 0) ? (Avg-Last)/Std : NULL_DOUBLE", "AdjZscore=signum(Zscore) * min(maxPos, max(abs(Zscore)-minEdge), 0.0)", "TargetPosition=(int)(liquidity*AdjZscore/Last)")

.dropColumns("ExchangeTimestamp", "Avg", "Std", "Zscore", "AdjZscore")

timeBinIndexes = targetPos.leftJoin(trades30min, "Sym", "Times=ExchangeTimestamp, SharesTraded=Size")

.updateView("StartIndex=binSearchIndex(Times, TimeBin-30*MINUTE, BS_LOWEST)", "EndIndex=binSearchIndex(Times, TimeBin, BS_HIGHEST)")

.dropColumns("Times")

shares30min = timeBinIndexes.updateView("SharesTraded30Min=sum(SharesTraded.subArray(StartIndex, EndIndex))")

.dropColumns("SharesTraded", "StartIndex", "EndIndex")

class SimulatorState

{

private HashMap<String, double[]> hm = new HashMap<>()

double[] update(String sym, int targetPos, int shares10s){

if (!hm.containsKey(sym)) hm.put(sym, new double[2])

double[] tradedAndPosition = hm.get(sym)

tradedAndPosition[0] = isNull(targetPos) ? 0.0 : signum(targetPos - tradedAndPosition[1]) * min(abs(targetPos - tradedAndPosition[1]), shares10s * 0.1d)

tradedAndPosition[1] += tradedAndPosition[0]

return Arrays.copyOf(tradedAndPosition, tradedAndPosition.length)

}

}

ss = new SimulatorState()

simulation = shares30min.update("Values=(double[])ss.update(Sym, TargetPosition, SharesTraded30Min)", "PositionChange=Values[0]", "Position=Values[1]")

.dropColumns("Values")# Initial import

from deephaven import *

# Mean Reversion Simulation

def rollingAvg(rows, values):

calculations = jpy.array('double', values.size()) # create an array of doubles

sum = 0

n = 0

for i in range(values.size()):

if i < rows:

n += 1 # n increments with i until n = rows

sum += values.get(i) # add each value to sum

if i >= rows:

sum -= values.get(i - rows) # subtract when needed

avg = sum/n # get updated average every iteration

calculations[i] = avg # store running average

return calculations # return an array of rolling averages

def rollingStd(rows, values):

# Can we use numpy and convolution here instead?

# some other kind of vectorization?

calculations = jpy.array('double', values.size()) # create an array of doubles

sum2 = 0

sum = 0

n = 0

for i in range(values.size()):

if i < rows:

n += 1 # n increments with i until n=rows

val = values.get(i)

sum += val

sum2 += val*val

if i >= rows:

# subtract when needed

val = values.get(i-rows)

sum -= val

sum2 -= val*val

variance = sum2/n - (sum*sum/(n*n))

calculations[i] = variance**0.5 if variance > 0 else 0 # account for numerical precision near 0

return calculations

trades = db.t("LearnDeephaven", "StockTrades")\

.where("Date=`2017-08-25`")\

.view("Sym", "Last", "Size", "ExchangeTimestamp")

trades30min = trades.updateView("TimeBin=lowerBin(ExchangeTimestamp, 30*MINUTE)")\

.firstBy("Sym", "TimeBin")

rollingCalc = trades30min.by("Sym")\

.update("Avg=(double[])rollingAvg.call(30, Last)", "Std=(double[])rollingStd.call(30, Last)")\

.ungroup()

minEdge = 0.5

maxPos = 3.0

liquidity = 1e6

targetPos = rollingCalc.updateView("Zscore= Std > 0 ? (Avg-Last)/Std : NULL_DOUBLE",

"AdjZscore=signum(Zscore) * min(maxPos, max(abs(Zscore)-minEdge), 0.0)",

"TargetPosition=(int)(liquidity*AdjZscore/Last)")\

.dropColumns("ExchangeTimestamp", "Avg", "Std", "Zscore", "AdjZscore")

timeBinIndexes = targetPos.leftJoin(trades30min, "Sym", "Times=ExchangeTimestamp, SharesTraded=Size")\

.updateView("StartIndex=binSearchIndex(Times, TimeBin-30*MINUTE, BS_LOWEST)",

"EndIndex=binSearchIndex(Times, TimeBin, BS_HIGHEST)")\

.dropColumns("Times")

shares30min = timeBinIndexes.updateView("SharesTraded30Min=sum(SharesTraded.subArray(StartIndex, EndIndex))")\

.dropColumns("SharesTraded", "StartIndex", "EndIndex")

from math import copysign

class SimulatorState:

def __init__(self):

self.hm = {}

def __call__(self, sym, targetPos, shares10s):

if sym not in self.hm:

self.hm[sym] = [0.0, ] * 2

tradedAndPosition = self.hm[sym]

tradedAndPosition[0] = 0.0 if (targetPos is None) else copysign(1, targetPos - tradedAndPosition[1]) * min(abs(targetPos - tradedAndPosition[1]), shares10s * 0.1)

tradedAndPosition[1] += tradedAndPosition[0]

return jpy.array('double', list(tradedAndPosition))

ss = SimulatorState()

simulation = shares30min.update("Values=(double[])ss.call(Sym, TargetPosition, SharesTraded30Min)",

"PositionChange=Values[0]", "Position=Values[1]")\

.dropColumns("Values")

Last Updated: 28 February 2020 12:20 -05:00 UTC Deephaven v.1.20200121 (See other versions)

Deephaven Documentation Copyright 2016-2020 Deephaven Data Labs, LLC All Rights Reserved